Planning a trip? Don’t let travel insurance myths derail your adventure. Misconceptions about travel insurance coverage can lead to costly mistakes, leaving you vulnerable to financial burdens from unexpected events. This article debunks the top travel insurance myths, providing you with the accurate information you need to make informed decisions about protecting your trip investment. Understanding the realities of travel insurance will empower you to travel with confidence and peace of mind. From medical emergencies to trip cancellations, knowing the truth about travel insurance is crucial.

Are you adequately protected? Many travelers fall prey to common travel insurance myths, believing they are covered when they are not. These misunderstandings can range from assumptions about pre-existing condition coverage to the belief that credit cards provide sufficient travel insurance. We’ll explore these myths in detail, exposing the truth behind the misconceptions and helping you understand the importance of travel insurance. Don’t let these travel insurance myths cost you; read on to learn the facts and ensure your next trip is truly protected.

Why Travel Insurance Is Often Misunderstood

Travel insurance is frequently perceived as an unnecessary expense or a luxury, leading to a common misunderstanding of its true purpose. Many travelers believe their regular health insurance provides sufficient coverage abroad, which is often not the case. Furthermore, the broad range of potential travel disruptions, from medical emergencies to lost luggage, are often underestimated.

This misunderstanding also stems from a lack of clarity regarding what travel insurance actually covers. Policies can be complex, and the specifics of coverage can vary greatly. Consequently, travelers may dismiss the value of a policy without fully understanding its potential benefits and the financial protection it can offer.

Myth 1: It’s Only for International Travel

Many believe travel insurance is exclusively for international trips. This is a misconception. Domestic travel can also benefit from the protection offered by travel insurance. Unexpected events like flight cancellations, lost baggage, or medical emergencies can occur whether you’re traveling across the country or across the globe.

Consider the potential costs of these disruptions. A missed flight could necessitate a costly last-minute hotel stay, and medical expenses can quickly escalate even within your own country. Travel insurance can provide financial assistance in these situations, regardless of your destination.

Myth 2: It Covers Everything Automatically

Travel insurance doesn’t offer blanket coverage. Assuming all scenarios are automatically protected is a dangerous misconception. Policies are designed with specific inclusions and exclusions.

Carefully review your policy details to understand what’s covered and, more importantly, what’s not. Common exclusions may include pre-existing conditions, certain adventure sports, or cancellations due to reasons not explicitly stated in the policy.

Myth 3: You Can Buy It Anytime

Many travelers mistakenly believe they can purchase travel insurance whenever they want, even up to the day before their trip. While some policies allow purchases close to departure, purchasing it last minute severely limits your coverage.

Pre-existing condition waivers, which protect you if a pre-existing medical condition flares up during your trip, often require purchase within a specific timeframe of your initial trip deposit. Additionally, cancel for any reason (CFAR) coverage usually has purchase deadlines, often within 10-21 days of the first trip payment. Waiting too long to buy travel insurance means potentially missing out on crucial protections.

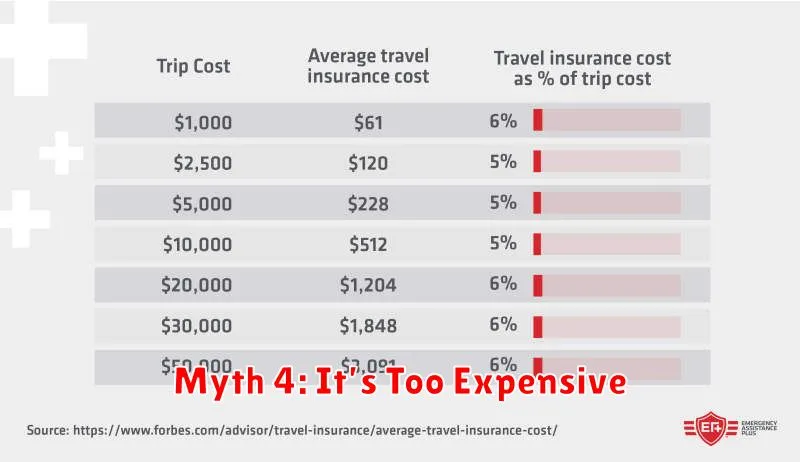

Myth 4: It’s Too Expensive

Many travelers believe travel insurance is a luxury they can’t afford. In reality, travel insurance is often a small fraction of the overall trip cost. Consider the potential financial losses you might face from trip cancellations, medical emergencies, or lost luggage. These costs can quickly dwarf the price of a policy.

Compare insurance quotes from different providers to find the best coverage for your needs and budget. You can often customize your policy to include only the coverage you need, further reducing the cost. Think of travel insurance as a small investment that safeguards a much larger one – your trip.

Understanding What’s Actually Covered

Many travelers purchase travel insurance based on assumptions, leading to disappointment when claims are denied. Thoroughly review your policy to understand covered reasons for trip cancellations, interruptions, or delays. Common misconceptions include believing any reason qualifies for a refund. Only specified unforeseen events, such as severe weather, documented medical emergencies, or certain airline issues are typically covered.

Lost luggage reimbursement is another area requiring careful examination. Policies may have limits on individual item value and overall payout. Pre-existing medical conditions often require supplemental coverage for comprehensive protection. It’s crucial to understand the specifics of your chosen policy to avoid unexpected costs and ensure adequate coverage.

Choosing the Right Policy Based on Your Trip

Not all travel insurance policies are created equal. The type of trip you’re taking heavily influences the coverage you’ll need. A simple domestic weekend getaway may only require basic coverage for lost baggage or minor medical emergencies.

However, an adventurous backpacking trip across Southeast Asia or a ski vacation in the Alps necessitates a more comprehensive policy. Consider factors like the destination, activities planned, and overall trip cost when selecting a plan.

For example, if you are planning on engaging in high-risk activities, such as scuba diving or rock climbing, ensure your policy covers these specifically.